Have a look at the most recent SCE Real estate Study which uses a comprehensive take a look at customers’ mind in regard to the real estate market.

I have actually constantly been interested by studies as they regularly provide me insights that I merely do not receive from simply taking a look at raw information. As luck would have it, the New York City Fed simply launched its 2023 Customer Expectations Real Estate Study. Now, this specific study has actually constantly offered me some terrific– and frequently unexpected– insights regarding how the U.S. population sees the general real estate market.

We definitely do not have time to cover all of the concerns that the study presents however there was one area I wished to show you today as it actually resonated with me, and it associates with home mortgage rates.

Concerns (and responses) from the Fed study

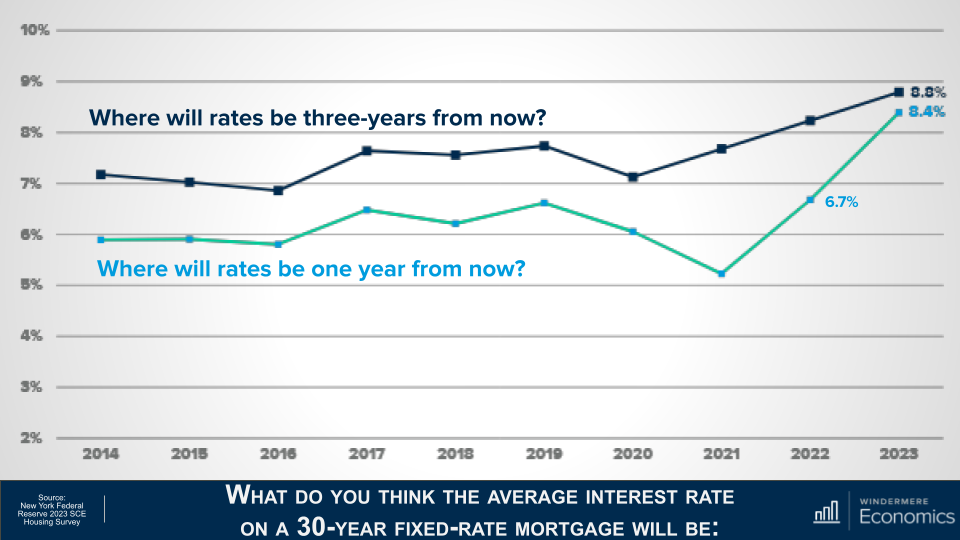

The very first concern asked was where they anticipated home mortgage rates to be one year from now.

And as you see here, usually, families anticipated rates to increase all the method approximately 8.4 percent.

Although some might see this as severe you can see that in the 2022 study participants anticipated rates would strike 6.7 percent– nearly precisely where they were at the start of this March.

And when asked where they believed rates would be 3 years from now once again, usually, families anticipated to see them climb up to 8.8 percent. Now, that’s a rate we have not seen because early 1995.

Well, I’m unsure about you, however I was really shocked by these outcomes as they counter almost every expert’s expectation concerning where rates will be over the next couple of years. In truth, myself, and every financial expert I understand, think that rates will gradually draw back as we move through this year, and I have not seen a single projection recommending that home mortgage rates will increase to a level this nation hasn’t seen in years.

However as they state, the devil’s in the information, and when I dug much deeper into the numbers, it ended up being really clear to me that demographics played a quite huge part in assisting individuals’s responses. Let me discuss.

Here the information is broken down by instructional accomplishment.

And you can see that study participants who didn’t have a college degree believed that home mortgage rates would increase to 9.4 percent within a year.

However college graduates were much more positive, and they anticipated rates to be in the high 6’s.

And when asked to look 3 years out, participants without degrees anticipated rates to break above 10 percent

While college graduates saw them drawing back a little from their 1 year expectations of 6.7 percent, down to 6.4 percent

Now we are going to take a look at the study results broken down by real estate period.

And here you see that occupants anticipate home mortgage rates to be at nearly 11 percent within a year.

And property owners likewise saw them increasing, however just approximately 7.3 percent

And over the next 3 years, occupants anticipated rates to break above 12 percent. That’s a level not seen because the fall of 1985.

However property owners anticipated to see rates at a rather more modest 7.4 percent.

So, what does this inform us? I see 2 things.

First of all, the fast boost in home mortgage rates that all of us saw beginning in early 2022 has a great deal of individuals thinking that we will see rates continuing to increase– in some cases at a really fast lane– over the next couple of years.

I suggest, if it took place in the past, why can’t it take place once again?

And this state of mind leads me to my 2nd point, which is that it’s really clear that a great deal of potential property buyers simply do not comprehend how home mortgage rates are computed.

The bottom line here is that I see a prospective purchaser swimming pool out there that requires informing which can provide a chance to brokers to go over how rates are set– and where the marketplace is anticipating to see them head moving forward.

And this might minimize the issues that lots of families have who might be believing that they will never ever have the ability to pay for to purchase a house due to the fact that of where they anticipate obtaining expenses to be in the future.

Education is whatever, do not you concur?

As constantly, I ‘d enjoy to get your ideas on this subject so please remark listed below.

Matthew Gardner is the primary financial expert for Windermere Property, the second-largest local realty business in the country.