Download the Databricks Insurance Coverage NLP Option Accelerator

Intro

The present financial and social environment has actually redefined consumer expectations and choices. Society has actually been required to end up being more digital, and this reaches customer care in insurance provider.

Nevertheless, there is a considerable difficulty in approaching this problem with a data-driven frame of mind. Historically, structured information has actually been the primary active ingredient that enables business to evaluate the past in order to comprehend and forecast the future. By leveraging Natural Language Processing (NLP), business can evaluate various sources of disorganized information created by consumers, such as audio from telephone call and complimentary text from chat messages.

Natural Language Processing (NLP) describes a set of innovations that allow computer systems to comprehend, translate, and produce human language. In the insurance coverage market, NLP can be utilized to automate jobs that need understanding and processing big quantities of composed or spoken language, especially in customer care, declares processing, and underwriting.

Today, consumers have various expectations relating to item modification and worth. They choose insurance coverage incorporated into their lives instead of something they restore when a year. A smooth consumer experience is now anticipated, with 58% of customers specifying that their customer care expectations are greater than they were a year back, according to TalkDesk. Another report from Bain & & Business exposes that worldwide, 59% of 28,765 customers in 14 nations desire life insurance companies to reward them for healthy living.

From the viewpoint of insurance coverage service providers, staying up to date with consumer needs can be difficult. Forrester approximates that 53% of assistance groups have actually seen a boost in assistance inquiries because the pandemic begun. Supplying a digital, self-service experience ends up being vital in order to lower pressure on insurance coverage contact centers.

Insurance provider have actually been utilizing chatbots and IVRs for several years to react to consumer inquiries about typical insurance coverage subjects such as inspecting the status of a claim, reporting claims, and comprehending insurance protection. Nevertheless, the difficulty is to guarantee that IVRs offer an interesting user experience without frustrating customer care representatives with excessive intricacy and overhead. According to Oliver Wyman, the majority of the discomfort points leading to a less-than-ideal consumer experience are as follows:

- Screening: Consumer chatbots typically have a hard time to translate more complicated consumer demands. These chatbots might have restricted understanding abilities, making it tough for them to comprehend the factor behind a consumer’s call. Big Language Designs (LLMs) have actually revealed better abilities compared to conventional Natural Language Processing (NLP) in this location.

- Routing: There is restricted routing of consumers, as the chatbot might not completely comprehend the nature of the consumer demand, leading to the consumer being routed to an individual, and more than likely waiting on hold once again.

- Resolution: Client service representatives do not have vital tools to solve questions rapidly. Chatbots might not precisely sum up consumer demands, obtain insurance coverage files to confirm protection, or offer a list of appropriate options for the representative. As an outcome, representatives might require to ask the consumer to duplicate the factor for calling, triggering additional hold-ups as they obtain the consumer’s policy and appropriate information, not to point out deterioration of the customer care experience.

To enhance the consumer experience, insurance provider ought to think about leveraging advanced innovations, such as LLMs, to improve chatbot understanding and routing abilities. Supplying representatives with extensive tools that enable fast access to consumer details and appropriate resources can likewise assist enhance the resolution procedure.

It can be intimidating for insurance companies to specify the very best technique for supplying much better consumer experience and care, while handling the difficulties of scaling and training their customer care labor force. How to appropriately stabilize the 2 sides of this coin? And most notably, where to begin?

Possible Results of Using NLP to Customer Care

Purchasing a holistic digital change technique can assist insurance provider flawlessly scale their operations while moving budget plans and personnels from functional procedures to real item and worth development. In the context of customer care, among the essential factors to consider when developing such a technique is call deflection. By comprehending typical consumer discomfort points and empowering them with self-service channels, insurance provider can scale more quickly while supplying a much faster and more appropriate consumer experience.

To use digital change to customer care in the insurance coverage domain, we require to comprehend why consumers are contacting us. For example, we might would like to know:

- What are the leading 10 factors for consumer calls?

- The number of consumers are requiring support with car insurance coverage versus other kinds of items, such as life insurance coverage or medical insurance?

- How are these circulations altering month-over-month or year-over-year?

These insights will enable us to create a correct technique for customer care, in addition to other locations such as marketing and use. Furthermore, we can evaluate which items or subjects are possibly bothersome, such as when there are a lot of contact re-occurrences from the very same consumer. Lastly, we require to examine whether our customer care group is well-prepared to serve our consumers.

Doing this sort of analysis needs companies to transform raw text into well-understood declarations (categorized text) and counts on structured information. In the context of natural language processing, transformer designs– such as BERT, GPT, and ChatGPT– have actually made it possible for business to draw out important, structured insights from this kind of information at an extraordinary scale. These designs enable simple category of consumer utterances based upon particular consumer intents, in addition to determining consumer belief.

Application Difficulties & & Inspiration

When a business comprehends its consumers, it can transfer to the best side of the Information and AI Maturity Curve. Natural Language Processing (NLP) and Transformer designs can help in automating consumer experiences, such as utilizing chatbots for engagement, and customization, such as anticipating consumer intents and their next interactions based upon previous history. Regardless of the capacity of NLP and Transformers, the present adoption landscape in the majority of business reveals that there is a considerable untapped chance. According to McKinsey, since completion of 2022, just 11% of business have or prepare to consist of Transformer designs as part of their AI items.

Option

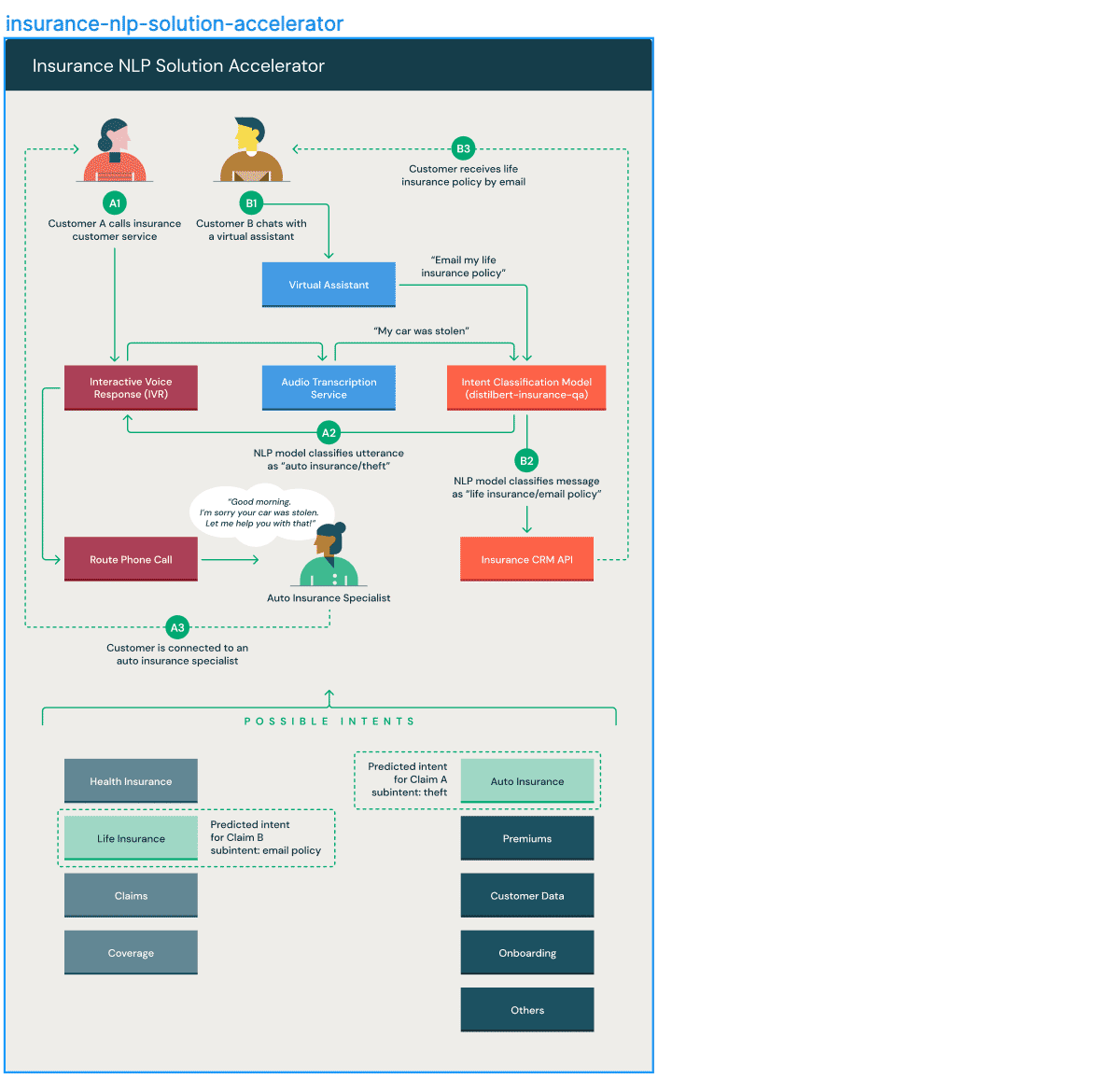

We are delighted to reveal the launch of a brand-new Option Accelerator specifically developed to set the technical finest practices and recyclable abilities around the development and upkeep of NLP and Transformers designs for insurance coverage call center analytics. The service accelerator is a set of artifacts (information, note pads, code, visualizations) that offers business a running start on establishing and releasing a maker finding out service. In the following areas, we will take a look at the various parts of this service accelerator.

The function of this service accelerator is twofold:

- Identifying consumer intents at scale based upon textual information from an Interactive Voice Reaction (IVR) stream or preliminary interactions in between a consumer and a service representative.

- Categorizing opening sentences from consumers to a customer care chatbot in real-time.

Conclusion

In conclusion, the abilities of NLP, Transformers, and Big Language Designs (LLMs) will continue to develop. Nevertheless, it is essential to keep in mind that no insurance provider has best information. Current modifications in the macroeconomic environment, such as inflation, supply chain interruptions, progressing loss patterns, and the effect of environment modification on disasters, in addition to labor force modifications and updates in underwriting guidelines and protection eligibility requirements, have actually considerably modified insurance companies’ company mix. As an outcome, historic information might not successfully generalize to future situations.

Insurance providers have 2 alternatives: they can either obtain external or third-party information to supplement their structured information originated from functional systems (such as policies, direct exposures, premiums, protection, and claims), or they can improve their internal structured information with internal disorganized information, consisting of voice calls/audio, images, text, and videos.

Summary

Our objective with this service accelerator is to show how simple it can be to accomplish digitization abilities by using consumer disorganized information and leveraging NLP, Transformers, and a Lakehouse platform.

To start on establishing and releasing a maker finding out service for finding consumer intent based upon pieces of text from an Interactive Voice Reaction (IVR) stream or from a virtual representative, download the Insurance Coverage NLP Option Accelerator

Download the Insurance Coverage NLP Option Accelerator