urfinguss

Horizon Champ Corporation ( NYSE: SKY) makes factory-built real estate in the U.S. and Canada. It offers made and modular houses, accessory home systems, park designs Recreational vehicles, and modular structures. They construct houses under Champ House Builders, Athens Park Designs, Atlantic Residences, New Period, and ScotBilt Residences brand names in the U.S. and SRI and Moduline houses brand names in Canada. SKY just recently revealed its FY23 and Q4 FY23 outcomes. In this report, I will evaluate its yearly and quarterly outcomes and discuss the difficulties it may deal with in FY24. I believe it is presently miscalculated. Thus I appoint a hold ranking on SKY stock.

Monetary Analysis

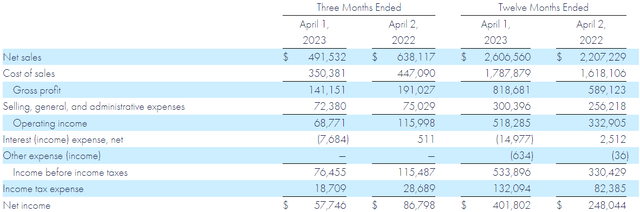

SKY just recently published its FY23 and Q4 FY23 results The net sales for FY23 were $2.6 billion, an increase of 18% compared to FY22. I think increased typical market price per house and $200 countless catastrophe relief real estate earnings taped in the very first half of FY23 were the primary factor behind the earnings boost. Their gross earnings margin for FY23 was 31.4%, which was 26.6% in FY22. I think the boost in gross margins was primarily due to functional performances, greater rate levels, and a disaster-relief real estate mix. The earnings for FY23 was $401.8 million, an increase of 62% compared to FY22. I believe a considerable increase in its incomes and running earnings caused an increase in the earnings.

The net sales for Q4 FY23 were $491.5 million, a decrease of 23% compared to Q4 FY22. I think the volume decrease in the U.S., which was brought on by seller stock destocking, was the primary factor behind the decrease. The variety of houses offered in the U.S. in Q4 FY23 was 4900, a decrease of 25.5% compared to Q4 FY22. Their factory-built house sales in Canada likewise decreased by 38.5% in Q4 FY23 compared to Q4 FY22, which likewise affected its incomes in Q4 FY23. Its gross earnings margins in Q4 FY23 were 28.7% compared to 29.9% in Q4 FY22. I think lower volumes affected its gross margins in Q4 FY23. Their earnings likewise decreased by 33.4% in Q4 FY23 compared to Q4 FY22.

Regardless of hard market conditions in 2022, they had the ability to increase their incomes, and their margins enhanced considerably, which is rather remarkable, however we need to take care as the real estate market industry is dealing with difficulties, and we might see its impacts on the business’s Q4 FY23 outcomes. I will even more discuss it later on in the report.

Technical Analysis

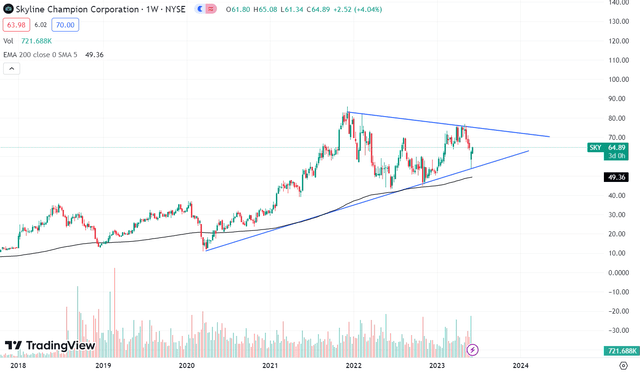

SKY is trading at the $65 level. The stock has actually been producing greater highs and greater lows considering that 2020 and is presently in an uptrend, however just recently it stopped working to produce a brand-new greater high and formed a lower high which can be an indication of pattern turnaround and can be a matter of issue. It is presently stuck in a rising triangle pattern, and if it breaks the lower pattern line, which is around $54, then the stuck may enter a drop. So, I think there is no purchasing chance in SKY today. One must just purchase it if it breaks the upper trendline, which is at $76, however till then, I believe one must keep away from the stock.

Should One Buy SKY Stock?

Initially, discussing the positives of the business. By the end of March 2023, they had money and money equivalents of $747.4 million and a very little long-lasting financial obligation of $12.4 million. In addition, in addition to its gross earnings margins, its changed EBITDA margins broadened 490 basis points in FY23, and they have a healthy three-year earnings [CAGR] of 23.92% and watered down EPS three-year [CAGR] of 90%. They had the ability to provide these numbers in the middle of hard market conditions, so it makes it much more remarkable. So its basics and its balance sheet appearance strong, however some headwinds may obstruct its development in FY24. Initially, it is dealing with difficulties like stock destocking due to low need, and we can see its result in its Q4 FY23 outcomes. Their sales and margins dropped considerably in Q4 FY23. Although inflation is now basically under control, the product and labor expenses are still high in the U.S. In addition, the rates of interest are still raised, and it is extremely not likely to drop in 2023. So taking a look at the difficulties, I believe they may deal with troubles in preserving its development rate in FY24.

Now discussing SKY’s appraisal. I will utilize P/E and EV/ Sales ratios to evaluate its appraisal. One can determine the P/E ratio by dividing a company’s market share rate by its EPS, and EV/ Sales ratio can be computed by dividing business worth by a company’s yearly sales. SKY has a P/E [FWD] ratio of 17.48 x compared to the sector ratio of 14.04 x and has an EV/ Sales [FWD] ratio of 1.49 x compared to the sector ratio of 1.15 x. After taking a look at both appraisal metrics, I think SKY is presently underestimated.

Thus taking a look at the headwinds, weak technical chart, and high appraisal. I believe it is best to prevent SKY in the meantime. Thus I appoint a hold ranking on SKY.

Threats and Disadvantages

They are governed by lots of ecological guidelines that cover the storage, discharge, dealing with, emission, generation, usage, and disposal of chemicals, strong and contaminated materials, and other harmful and dangerous products utilized in producing or emerging from their items.

One can not prepare for the nature, degree, or effect of possible future regulative responsibilities that might use to its organization or how present or possible laws would be used or interpreted. Products, items, or practices that have actually not formerly been controlled might undergo guideline.

The costs of sticking to brand-new, more stringent guidelines or of more zealous enforcement of these or existing constraints might be significant. Ecological guidelines require them to maintain and comply with a variety of licenses, permissions, and approvals, along with to maintain and upgrade training programs and security info about the products utilized in its treatments. Punitive damages and other enforcement actions might be taken in action to offenses of these requirements.

In addition, they can be asked to stop several elements of their organization up until the infraction is treated. The costs of remedying offenses or ending enforcement actions that the federal government may bring might be high and may have an effect on the business’s operations and financial resources

Bottom Line

SKY had an incredible FY23, however there are lots of headwinds they may deal with in FY24. So I believe FY24 may not be as great as FY23 in regards to development. In addition, its technical chart is revealing weak point, and the appraisal likewise appears high. Thus I appoint a hold ranking on SKY.