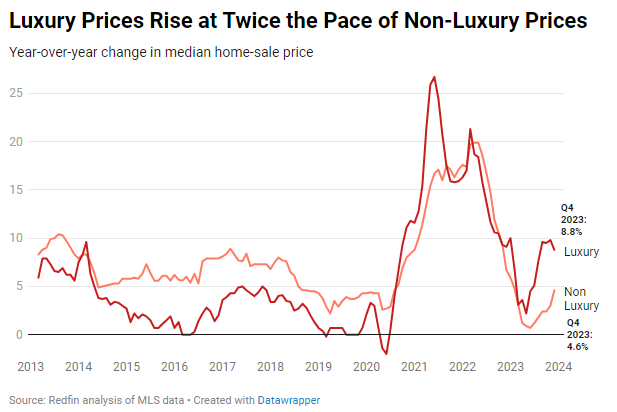

Rates of high-end homes increased at two times the rate of non-luxury homes at the end of 2023, partially due to the fact that raised home loan rates are unimportant to numerous upscale purchasers. Low stock is another element driving costs up: Despite the fact that high-end brand-new listings increased, total supply is still listed below pre-pandemic standards.

The normal U.S. high-end home cost a record $1.17 million in the 4th quarter, up 8.8% from a year previously. Rates of non high-end homes increased at half the rate, increasing 4.6% year over year to a record $340,000.

This is according to an analysis that divided all U.S. homes into tiers based upon Redfin Quotes of the homes’ market price since January 2024. This report specifies high-end homes as those approximated to be in the leading 5% of their particular city location based upon market price, and non high-end homes as those approximated to be in the 35th-65th percentile based upon market price.

The outsized boost in high-end costs, in addition to a dive in high-end brand-new listings and enhancing sales, signal that upscale property buyers and sellers are ending up being more active.

Share of high-end homes purchased in money strikes record high

A record-high share of all-cash high-end home purchases drove the relative strength of the high-end real estate market: Almost half (46.5%) of the 4th quarter’s high-end purchases were made in money, up from 40% a year previously.

High-end costs are increasing at two times the rate of non-luxury costs mostly due to the fact that a lot of upscale purchasers have the ability to purchase homes in money, rendering today’s raised home loan rates unimportant. High home loan rates have a more chilling impact on the remainder of the market, upping interest payments and keeping cost boosts modest.

” A great deal of high-end purchasers are can be found in with money, grabbing pricey homes,” stated Heather Mahmood-Corley, a Redfin Premier representative in Phoenix. “High-end homes are offering quickly, specifically in preferable locations like glamorous Scottsdale, or Tempe, which West Coast transplants like due to the fact that it’s centrally situated. One customer just recently purchased a home in Tempe, turned it, and it cost $1.4 million in 2 days.”

Low stock is another element pressing high-end costs up. Despite the fact that the supply of high-end homes rose from a year previously, it’s still well listed below pre-pandemic levels, resulting in competitors from well-off purchasers over a minimal variety of homes.

New listings climb up almost 20% year over year to pre-pandemic levels

New listings of high-end homes leapt 19.7% year over year in the 4th quarter, the greatest boost in over 2 years. The boost brings the variety of U.S. brand-new high-end listings to simply under 53,000, equivalent to fourth-quarter levels in 2018 and 2019, right before the pandemic begun.

By contrast, brand-new listings of non high-end homes fell approximately 3% from a year previously– though that’s the tiniest decrease in a year and a half.

High-end brand-new listings skyrocketed for numerous factors:

- High-end sellers put their homes on the marketplace to squander while costs were high.

- The mortgage-rate lock-in impact does not keep back upscale purchasers as much as middle-income purchasers.

- New listings had a great deal of space to grow, as they were sitting at their most affordable level in a years at the end of 2022.

The overall variety of high-end homes for sale likewise skyrocketed, increasing 13% year over year. Overall non-luxury stock dropped 9.7%.

Regardless of the huge year-over-year dive, overall high-end stock is still listed below normal fourth-quarter levels. However the overall supply of high-end homes is most likely to increase more in 2024. That’s due to the fact that brand-new listings have actually currently increased substantially, and more high-end property owners are most likely to get on the selling bandwagon due to the fact that they can command record-high costs.

” More high-end listings will temper cost development as the year goes on,” stated Redfin Senior citizen Economic expert Sheharyar Bokhari “In general, that’s an advantage for the high-end market: Sellers will still bring reasonable costs, purchasers will have more to select from and sales must tick up.”

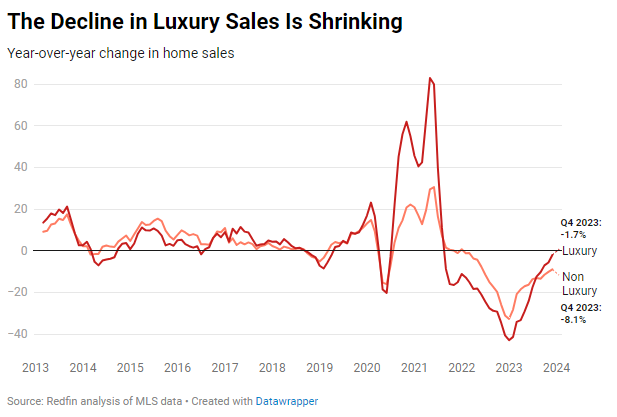

High-end sales fall 2% from a year previously– the tiniest decrease in over 2 years

Sales of high-end homes dropped 1.7% year over year in the 4th quarter, the tiniest decrease because the middle of 2021. That’s compared to an 8.1% decrease for non-luxury homes, the tiniest because the start of 2022– however 4 times larger than the decrease in high-end sales.

High-end sales published a reasonably little decrease due to the fact that of the uptick in brand-new listings: More homes on the marketplace cause more sales. The lower effect of high home loan rates on upscale purchasers is another factor high-end sales decreased much less than non-luxury sales.

Metro-Level High-end Emphasizes: Q4 2023

Redfin’s metro-level high-end information consists of the 50 most populated U.S. city locations. Some cities are gotten rid of from time to time, to make sure information precision. All modifications kept in mind below are year-over-year modifications.

- Rates: The typical list price of high-end homes increased most in Newark, NJ (11.6%), New Brunswick, NJ (10.9%) and Orlando (10.8%). It fell in simply 8 cities, with the greatest decreases in Austin, TX (-8.6%), Las Vegas (-6.1%) and Jacksonville, FL (-2.3%).

- New listings: New listings of high-end homes increased most in Phoenix (42.3%), Tampa, FL (41.6%) and New York City (31.6%). They fell most in Milwaukee (-16.7%), Baltimore, MD (-10.2%) and Chicago (-4.4%).

- Active listings: The overall variety of high-end homes for sale increased most in Austin, TX (44.5%), San Antonio, TX (33.1%) and Tampa, FL (30.4%). It fell most in Detroit, MI (-14.7%), Oakland, CA (-12.6%) and Newark, NJ (-11.9%).

- Home sales: High-end home sales increased most in Las Vegas (33.9%), Tampa, FL (24.3%) and Pittsburgh, PA (21.5%). They fell most in New york city (-21%), Charlotte, NC (-21%) and Kansas City, MO (-20.8%).

10 A Lot Of Pricey U.S. Home Sales: Q4 2023

-

- Miami, FL (Indian Creek Town): $79M

- New York City, NY: $75M

- New York City, NY: $65.6 M

- Aspen, CO (Glenwood Springs): $60M

- New York City, NY: $47M

- Aspen, CO (Glenwood Springs): $42.3 M

- San Francisco, CA (Atherton): $40M

- Fort Lauderdale, FL: $40M

- Miami, FL (Miami Beach): $35.4 M

Los Angeles, CA: $34.6 M

| High-end Housing-Market Summary by City Location: Q3 2023 | ||||||

| Typical list price | Typical list price, YoY | Active listings, YoY | Brand-new listings, YoY | Houses offered, YoY | Days on market | |

| Anaheim, CA | $ 4,050,000 | 9.1% | 12.4% | 23.2% | 16.8% | 59 |

| Atlanta, GA | $ 1,312,500 | 10.8% | -0.7% | 5.8% | 3.4% | 38 |

| Austin, TX | $ 1,690,000 | -8.6% | 44.5% | 28.0% | 13.5% | 91 |

| Baltimore, MD | $ 1,125,000 | 7.1% | -8.8% | -10.2% | -6.9% | 33 |

| Boston, MA | $ 2,244,500 | 2.3% | 11.8% | 9.9% | -3.2% | 33 |

| Charlotte, NC | $ 1,350,000 | 8.9% | 6.8% | 26.4% | -21.0% | 43 |

| Chicago, IL | $ 1,200,000 | 9.1% | -11.6% | -4.4% | -1.6% | 73 |

| Cincinnati, OH | $ 793,750 | 5.3% | -10.1% | 7.3% | -2.6% | 19 |

| Cleveland, OH | $ 700,000 | 2.9% | -0.7% | 11.2% | -5.7% | 35 |

| Columbus, OH | $ 855,000 | 8.2% | 13.1% | 14.0% | 4.5% | 45 |

| Dallas, TX | $ 1,400,000 | 6.5% | 18.7% | 15.0% | 4.4% | 46 |

| Denver, CO | $ 1,625,000 | -0.8% | 26.4% | 15.1% | -1.7% | 32 |

| Detroit, MI | $ 610,000 | 1.7% | -14.7% | 5.9% | -12.8% | 22 |

| Fort Lauderdale, FL | $ 1,685,000 | 8.7% | 11.7% | 20.8% | 7.7% | 85 |

| Fort Worth, TX | $ 1,018,000 | -0.7% | 26.6% | 26.4% | 11.0% | 51 |

| Houston, TX | $ 1,153,600 | 5.5% | 9.7% | 15.1% | -6.4% | 39 |

| Indianapolis, IN | $ 849,065 | 6.6% | 11.3% | 7.2% | -3.0% | 24 |

| Jacksonville, FL | $ 1,320,000 | -2.3% | 24.7% | 28.3% | 8.1% | 45 |

| Kansas City, MO | $ 869,900 | 3.8% | 12.1% | 5.8% | -20.8% | 33 |

| Las Vegas, NV | $ 1,150,000 | -6.1% | -8.0% | 20.4% | 33.9% | 64 |

| Los Angeles, CA | $ 3,525,000 | 3.7% | 11.3% | 8.4% | -1.4% | 61 |

| Miami, FL | $ 2,825,000 | 8.7% | 12.0% | 20.3% | -5.4% | 119 |

| Milwaukee, WI | $ 910,000 | 7.1% | -1.8% | -16.7% | -1.3% | 56 |

| Minneapolis, MN | $ 987,500 | 0.6% | 20.8% | 26.6% | 2.5% | 35 |

| Montgomery County, PA | $ 1,300,000 | 8.3% | -7.5% | -2.3% | -15.1% | 37 |

| Nashville, TN | $ 1,630,922 | 5.9% | 29.0% | 22.5% | -4.2% | 84 |

| Nassau County, NY | $ 2,500,000 | 6.0% | 5.0% | 26.4% | -8.3% | 71 |

| New Brunswick, NJ | $ 1,875,000 | 10.9% | -8.7% | 9.5% | -9.1% | 51 |

| New York City, NY | $ 3,500,000 | 0.4% | 9.3% | 31.6% | -21.0% | 142 |

| Newark, NJ | $ 1,600,000 | 11.6% | -11.9% | -3.9% | 0.0% | 34 |

| Oakland, CA | $ 2,760,000 | 7.8% | -12.6% | 8.0% | -8.6% | 14 |

| Orlando, FL | $ 1,163,250 | 10.8% | 16.2% | 30.1% | -0.4% | 29 |

| Philadelphia, PA | $ 1,000,000 | 2.6% | 9.0% | 20.1% | -18.2% | 38 |

| Phoenix, AZ | $ 1,630,000 | 4.8% | 13.5% | 42.3% | 19.5% | 52 |

| Pittsburgh, PA | $ 749,900 | -2.2% | 22.8% | 23.0% | 21.5% | 63 |

| Portland, OR | $ 1,295,000 | -0.1% | 19.2% | 3.9% | 0.3% | 43 |

| Providence, RI | $ 1,410,000 | 8.5% | 3.2% | 6.2% | 2.5% | 51 |

| Riverside, CA | $ 1,400,000 | 5.7% | 9.8% | 16.2% | 17.6% | 50 |

| Sacramento, CA | $ 1,481,500 | 5.5% | 7.3% | 21.8% | 14.2% | 44 |

| San Antonio, TX | $ 950,000 | 3.3% | 33.1% | 24.0% | -9.7% | 63 |

| San Diego, CA | $ 3,235,000 | 10.2% | 12.1% | 9.6% | 1.7% | 59 |

| San Francisco, CA | $ 4,850,000 | 2.1% | 10.8% | 0.8% | 15.6% | 31 |

| San Jose, CA | $ 4,559,500 | 9.5% | -11.6% | 5.9% | 3.7% | 15 |

| Seattle, WA | $ 2,618,000 | -0.1% | 4.5% | 11.7% | 8.8% | 21 |

| St. Louis, MO | $ 838,207 | 6.0% | -2.8% | -1.5% | -5.8% | 20 |

| Tampa, FL | $ 1,385,800 | 2.7% | 30.4% | 41.6% | 24.3% | 24 |

| Virginia Beach, VA | $ 1,034,450 | 8.9% | -4.3% | 3.6% | -7.8% | 31 |

| Warren, MI | $ 850,000 | 4.9% | -0.3% | 8.5% | -12.7% | 32 |

| Washington, DC | $ 1,700,000 | 4.6% | 6.8% | 6.2% | -4.6% | 37 |

| West Palm Beach, FL | $ 2,750,000 | 3.8% | 25.3% | 31.6% | 3.8% | 71 |

| U.S. | $ 1,170,000 | 8.8% | 13.0% | 19.7% | -1.7% | 50 |