Previously today, I signed up with Ciena and Telstra for a live webinar highlighting Asia-Pacific market chauffeurs, patterns, and brand-new cable television develops.

Throughout my session, which concentrated on Trans-Pacific submarine cable television patterns, content suppliers showed up a fair bit.

These business focus on the requirement to connect their information centers and significant affiliation points. As such, they frequently release enormous quantities of capability on core paths.

The Trans-Pacific and Intra-Asia paths are 2 excellent examples.

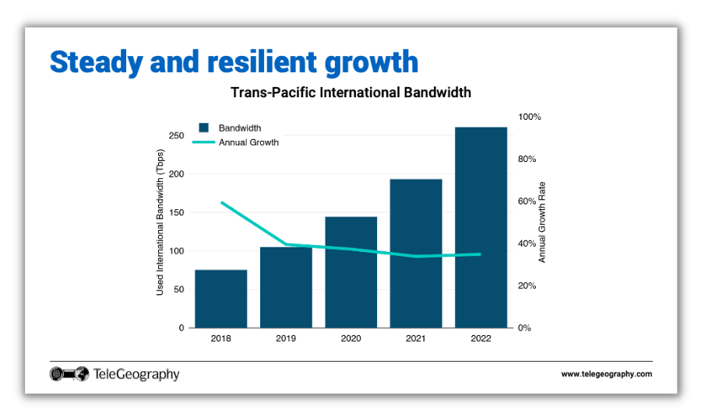

I started my discussion by revealing Trans-Pacific worldwide bandwidth from 2018 to 2022.

This chart reveals that bandwidth need development throughout the Pacific has actually stayed resistant and rather constant for many years. Trans-Pacific bandwidth grew 35% year-over-year in 2022 alone, reaching simply over 250 Tbps of capability.

Although the blue-green line reveals a dip in yearly development prior to supporting in 2019, the more crucial takeaway is the outright boost in healthy bandwidth development for many years.

And who is taking in all of this bandwidth?

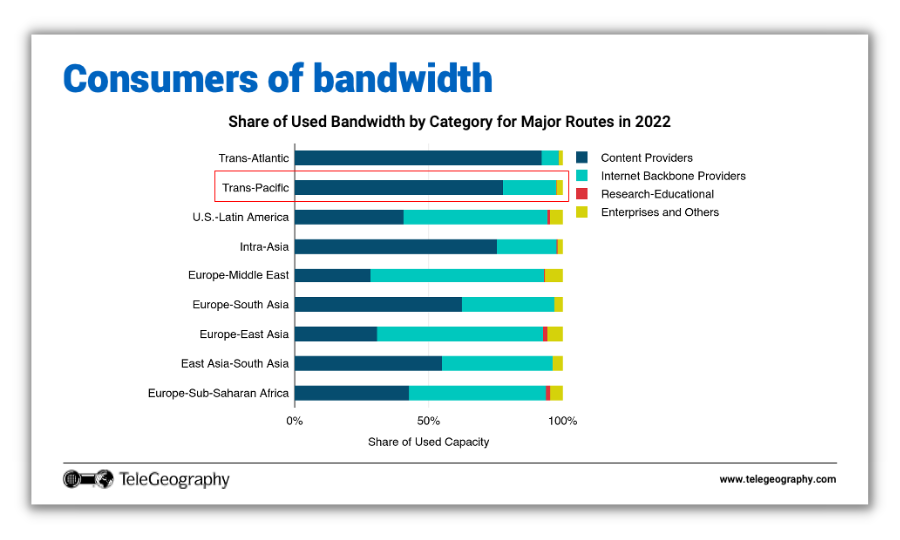

The slide listed below breaks down 4 various classifications of bandwidth users– Material Providers, Web Foundation Providers, Research-Educational, and Enterprises and Others– throughout numerous significant paths.

We can see that bandwidth use is not equally dispersed throughout these classifications.

Material suppliers, displayed in navy blue, use up substantial shares of capability throughout the Pacific and Intra-Asia (roughly more than 78% and 75% of bandwidth, respectively).

On the other side, web foundation suppliers (blue-green), still take in bigger volumes of bandwidth on particular paths, like U.S.-Latin America, Europe-Middle East, and so on

With that being stated, we prepare for a basic boost in content company share of bandwidth throughout the majority of these paths in the years to come. Need from other kinds of users is likewise growing, simply not as quickly as content company need.

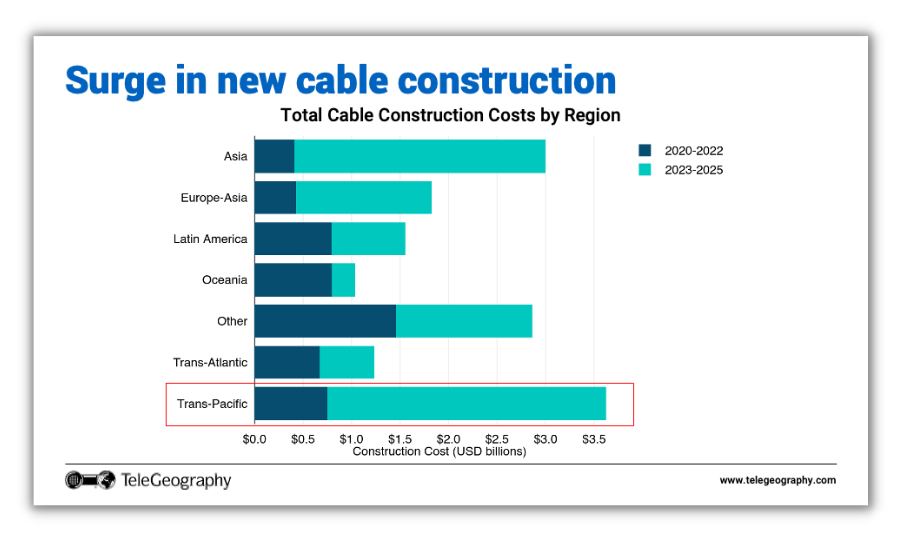

Unsurprisingly, the boost in bandwidth need has actually resulted in a rise in brand-new cable television financial investment.

Unsurprisingly, the boost in bandwidth need has actually resulted in a rise in brand-new cable television financial investment. As we can see in the figure listed below, there are a great deal of cable televisions getting in service in the next 3 years.

Concentrating On the Trans-Pacific alone, the building and construction worth for cable televisions getting in service from 2023-2025 is substantially greater compared to 2020-2022.

We likewise witness likewise high levels of cable television financial investment in Asia– likewise referred to as Intra-Asia– as there is a requirement to disperse this capability within the area. Keep in mind that there might be more, unannounced cable televisions on the horizon, which might even more pump up these worths.

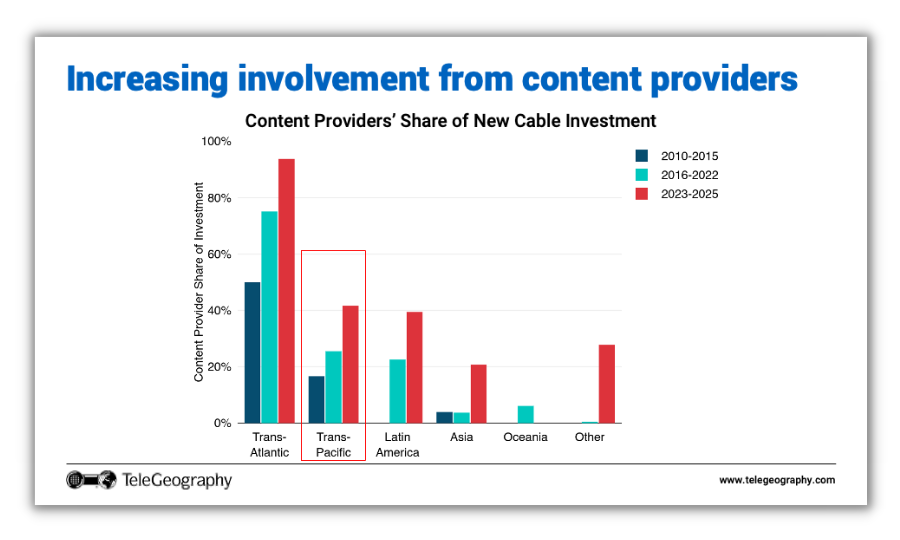

Previously in my discussion, I developed that material suppliers take in more bandwidth on particular paths.

If we break down material company financial investment in brand-new cable televisions by period, we see boosts throughout the board.

Almost half of all Trans-Pacific cable television financial investments getting in service in between 2023-2025 are backed and moneyed by material suppliers.

Almost half of all Trans-Pacific cable television financial investments getting in service in between 2023-2025 are backed and moneyed by material suppliers.

And our company believe that this pattern is most likely to increase in the future.

Next, my discussion covered why worldwide rate disintegration is slowing, the truth of U.S. and China decoupling, and an introduction of all old and brand-new cable television systems throughout the Pacific.

If you wish to check out these subjects, you can download my slides over here An on-demand recording of the complete webinar is likewise offered to enjoy here