India’s reserve bank has actually stopped its prepare for a prominent job meant to measure up to the country’s dominant payment system, Unified Payments User Interface. The job had actually drawn in substantial interest from a range of significant corporations, tech giants, and banks, consisting of Amazon, Dependence, Facebook, Tata Group, Google, HDFC, and ICICI.

The Reserve Bank of India had at first welcomed quotes in 2021 for licenses to run brand-new retail payment and settlement systems throughout India. The job was called New Umbrella Entity, or NUE.

Nevertheless, according to RBI Deputy Guv T Rabi Sankar, the job’s capacity individuals stopped working to propose “any ingenious or infrastructural services.” Sankar highlighted the reserve bank’s interest in checking out concepts that exceed incremental enhancements or replacement for existing innovations.

UPI, which now processes over 8 billion deals a month, was inching closer to the 1 billion turning point in 2021. The reserve bank looked for to alleviate concentration threat as UPI’s value in the economy continued to grow, intending to establish an alternative procedure that would minimize stress on the existing system.

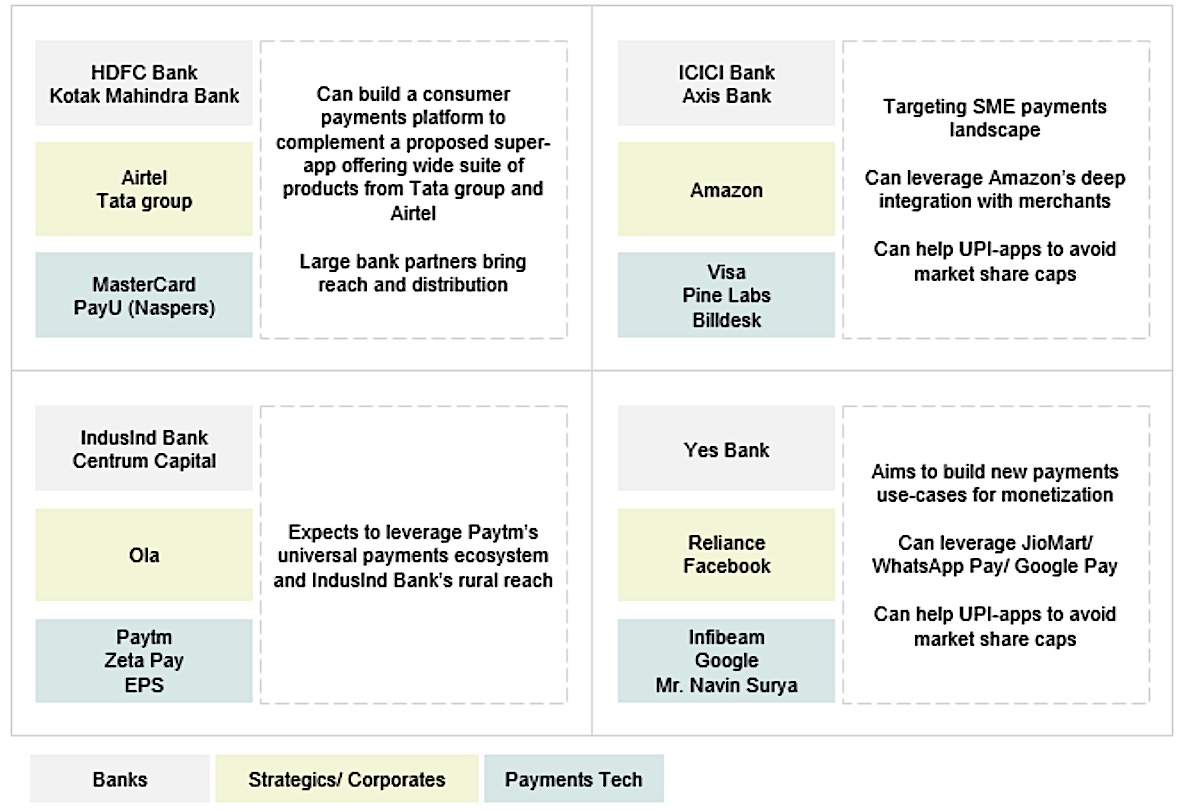

Market gamers had actually formed 4 consortia and were preparing to try for the NUE license. Image: Bernstein

PhonePe and Google Pay were commanding one of the most market share in UPI in 2021– very little has actually altered– and numerous market individuals saw NUE as a method to be early and aggressive with a brand-new payments system.

In an earlier proposition, RBI looked for NUEs to be interoperable with each other.

” Therefore, NUEs do not have any exclusive gain access to. Nevertheless, NUEs can tailor the networks to their service design and circulation abilities. If a corporation is strong in e-commerce, the NUE might tailor to the particular requirements of that use-case. UPI has actually market share caps/calibrated development for brand-new gamers (eg. WhatsApp). NUEs would not have such limitations and may assist with sped up network impacts for personal gamers. Therefore, NUEs personalized style and self-governance might offer more powerful abilities. Unlike UPI’s generic payment network, NUEs will have personalized networks based upon use-cases,” Bernstein composed in a report in 2021.